Introducing: 2-Step Verification (2SV)

Learn how to enroll in 2SV

Note: there will be a brief disruption to online and mobile banking logins at 12pm on February 13 during the launch of 2SV.

Introduction

2-Step Verification (2SV) replaces the use of static challenge questions and answers with dynamically generated one-time verification codes. The codes are sent by SMS text message, email, or an automated voice call to a phone number or email address registered by a user during initial setup.

When authenticating using 2SV, users are presented with a screen that advises them that a verification code has been generated and sent to them. Users must retrieve the verification code using their previously configured method (text message, email, or voice call). Once the code is entered and verified, authentication is complete, and the user can proceed with their digital banking activities. Users have several attempts to provide the correct verification code before their account is locked out.

How it Works

Enrollment

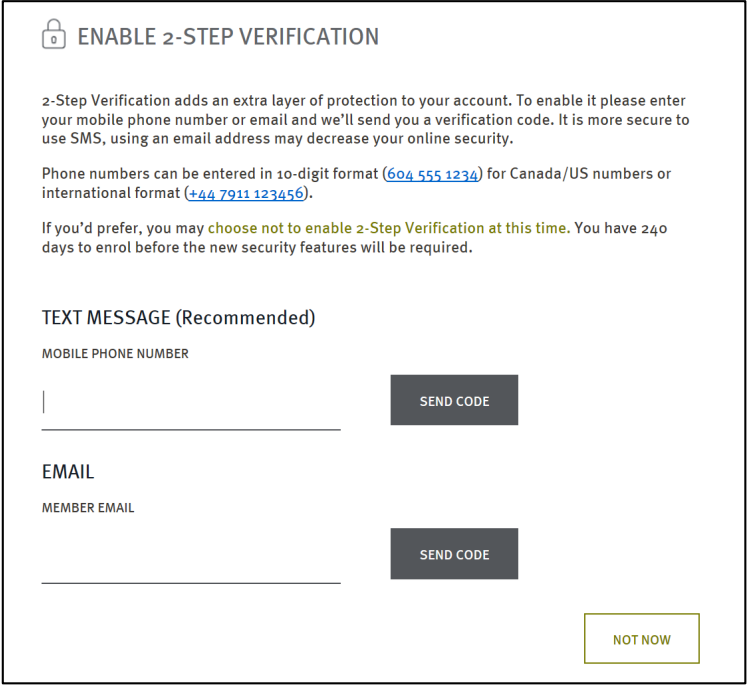

Starting on February 13 2024, you will be presented with an Enable 2-Step Verification enrollment screen when you next sign-in to online or mobile banking. See the image below:

There is a grace period of 90 days starting on February 13 2024. During the enrollment grace period, you have the option of deferring enrollment by selecting the Not Now option on the enrollment screen. During the grace period, you will continue to be challenged with your security questions until you register for 2SV. Once the grace period ends, you will be forced to configure 2SV in order to continue using online banking services.

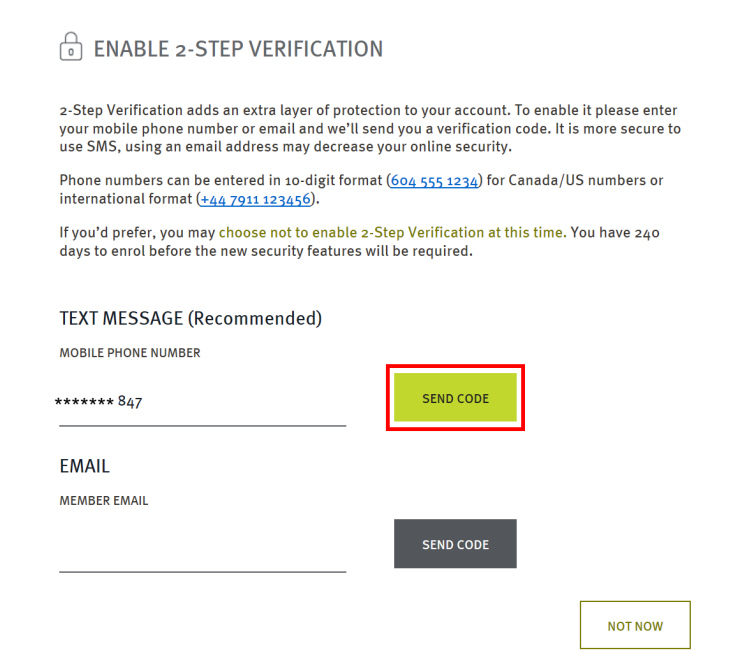

During the 2SV registration process, you will be prompted to choose between receiving a Text Message, Email, or Voice Call. Enter a valid phone number or email address, then select Send Code to submit it for registration. See the image below:

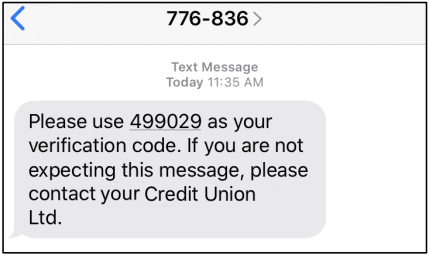

By selecting Send Code, a verification code is sent in a notification to the mobile phone or email address that was entered. See the image below for an example using the text message option:

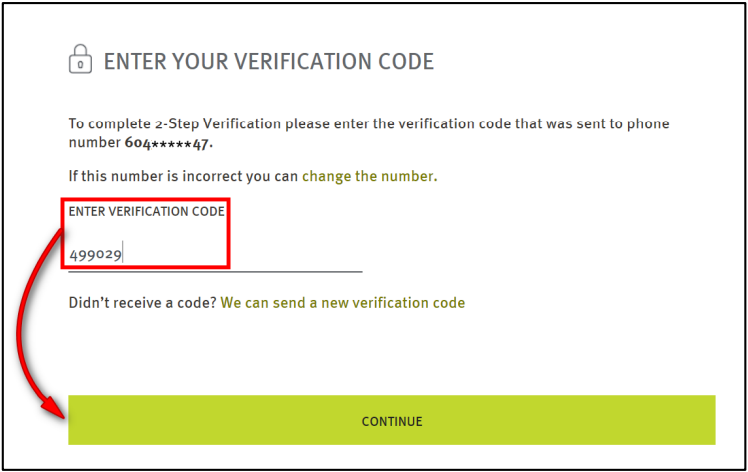

Retrieve the code from the notification and enter it on the Enter Your Verification Code screen, which is now displayed and awaiting your input.

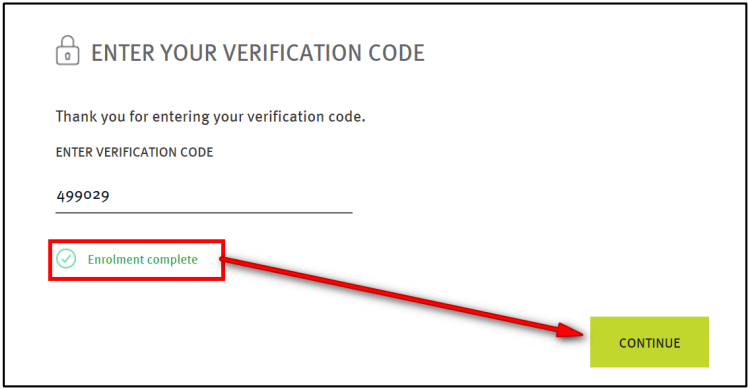

Once the verification code is entered, the select Continue to submit the code for verification. See the images below:

The enrollment process ensures that a valid mobile phone number or email address has been provided and has been successfully tested to receive notifications.

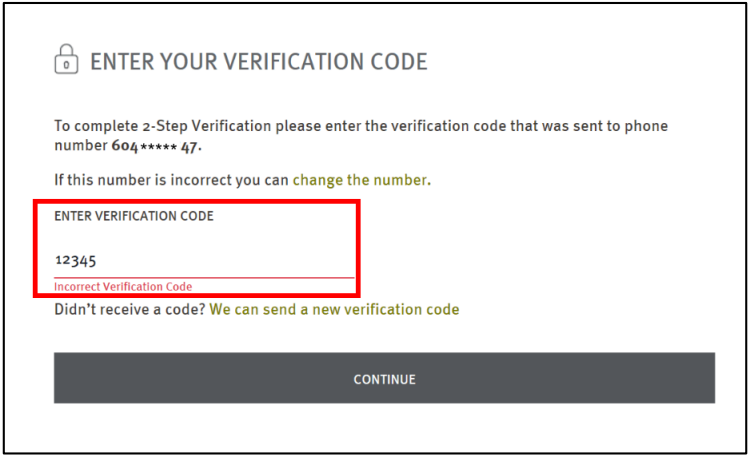

If, during enrollment, you fail to enter the correct verification code on the Enter Your Verification Code screen, you will see an on-screen error message when you select Continue. See the image below. During enrollment, you have an unlimited number of attempts to provide the correct registration code.

Using 2-Step Verification After Enrollment

After successfully enrolling in 2-Step Verification, you will be presented with the Enter Your Verification Code screen instead of a challenge question whenever the system detects a "high-risk" login, and a verification code will be sent to the phone or email address that you registered during enrollment.

Simply enter the code, and select Continue to proceed with your online banking.

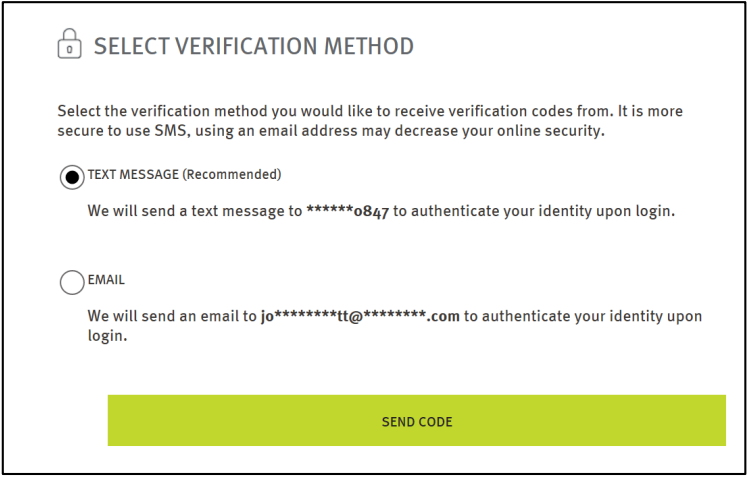

If you have registered both a phone number and an email to receive codes, you will be asked to select which option you would like to use. Select the option you would like to use, and then select Send Code. See the image below:

Retrieve the verification code from the notification, enter it on the Enter Your Verification Code screen and select Continue to submit it for verification.

If the submitted code is verified, the verification screen is dismissed, allowing the you to access your online or mobile banking. If verification fails, you will receive an error messages on the verification screen with each failed submission.

There is a limit of three attempts to enter the verification code before your account is locked. If your account is locked due to invalid 2SV codes, please contact the credit union for assistance.

2-Step Verification for High-Risk Transactions

- Adding a new e-Transfer recipient

- Editing an existing e-Transfer recipient

- Sending an e-Transfer

- Changing your online banking password

Once you complete the 2SV process for one of the transactions above, you will not be prompted again for 15 minutes. If you logout of online banking, the 15 minute timer will immediately reset.